Market Review - Oct/Nov 2022

Residential Rental Report - Second Quarter 2022

Residential Rental Report - Second Quarter 2022

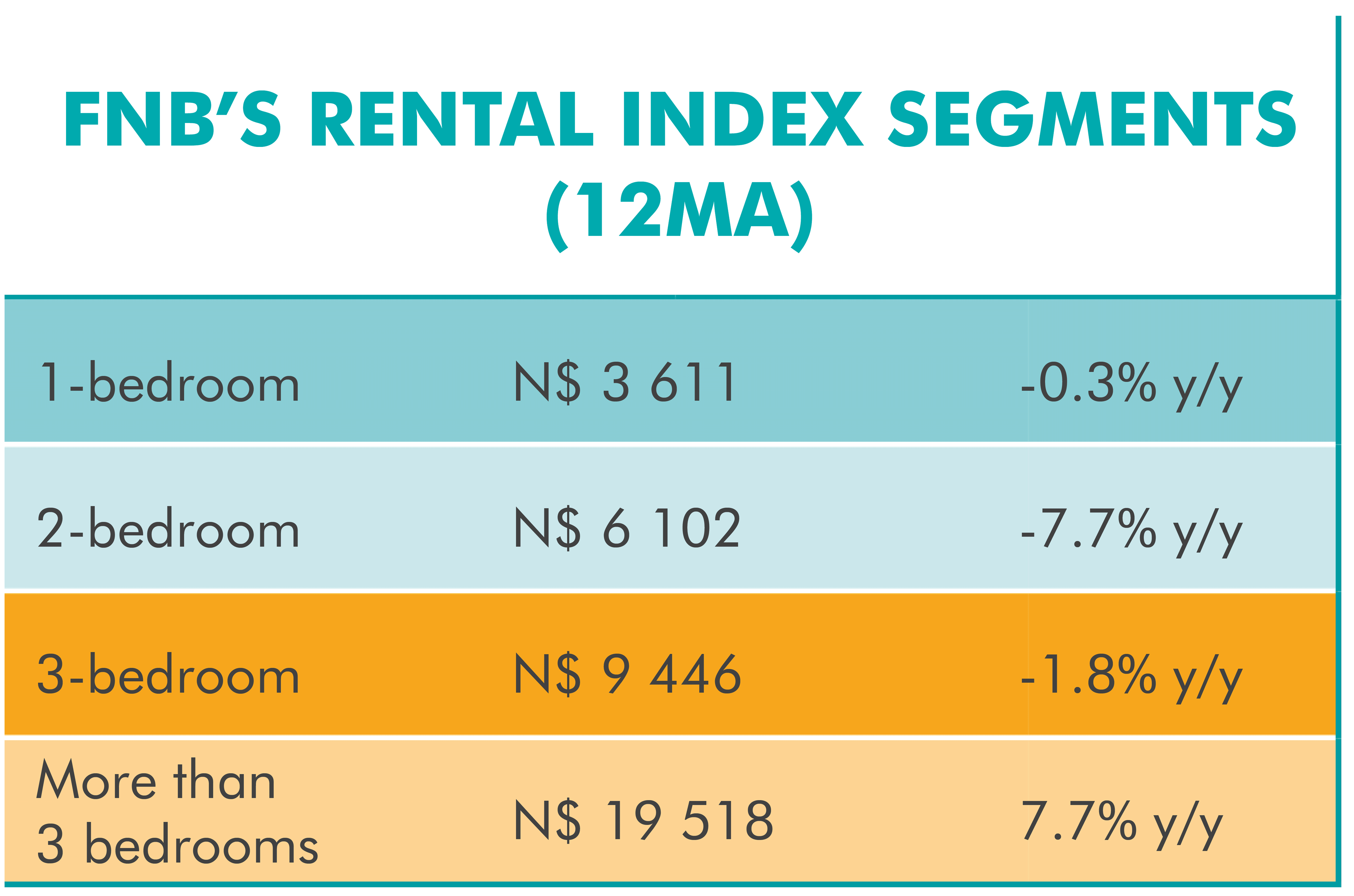

Key Highlights- The 12-month average rental index growth contracted by 1.7% at the end of June 2022.

- The national weighted average rent moderated in the 12 months to N$ 6 821 from N$ 6 948 recorded a year earlier.

- Rental growth continues to be supported by the more-than-three-bedrooms segment registering y/y growth of 7.7% to N$ 19 518.

- Residential rental listings contracted by 70.9% q-o-q to 2 181 units.

- Rental yields moderated downwards to 6.7% at the end of June 2022 against the prevailing average inflation of 4.7%.

Rent growth retreats into negative territory

Following two consecutive months of growth, the 12-month average growth in the FNB rental index contracted by 1.7% at the end of June 2022. This unexpected setback was mainly driven by price contraction of 7.7% y/y within the two-bedroom segment, which reached a 12-month average level of N$ 6 102. This is the lowest level seen in 6 years and highlights the impact of a sudden economic shock on households, characterized by rising interest rates, inflation and fuel prices. The one-bedroom and three-bedroom segments also disappointed, posting rental contractions of 0.3% and 1.8% y/y at the end of June 2022, namely N$ 3 611 and N$ 9 446, respectively.

Stability is evident in the more-than-three-bedrooms segment on the back of improved tenant retention. In effect, this segment registered rental growth of 7.7% y/y, bringing the 12-months average rent to N$ 19 518 from N$ 18 129 recorded a year earlier. Consequently, the overall 12-months national weighted average rent came in at N$ 6 821 at the end of June 2022 from N$ 6 948 recorded over the same period of 2021. Although the rental market recovered somewhat between the second half of 2021 and the first quarter of 2022, agents and landlords should continue to remain mindful of the negative effects of the current macroeconomic environment on tenants’ ability to pay their rent. On the flipside, rising interest rates and the subsequent reduced appetite to borrow may also mean that some higher-income tenants may decide to keep on renting instead of buying their own properties.

Additionally, the regional market analysis shows year-on-year rental contractions across most jurisdictions such as Oshakati (-29.6%), Ondangwa (-21.8%), Rehoboth (-18.1%), Rundu (-13.8%), Arandis (-12.8%), Windhoek (-8.0%), Walvis Bay (-5.6%) and Ongwediva (-2.5%). In contrast, Swakopmund recorded a surge in rental growth of 20.4% and continues to attract high demand for larger lifestyle properties in general. This is not surprising given the impressive rise in residential building plans that have been approved and completed in Swakopmund relative to the rest of the country. This signals the growing attractiveness of the coastal region as an ideal jurisdiction for residential property investment. In fact, Swakopmund accounted for 42.1% of N$ 116.6 million value of building plans completed in May 2022 based on the NSA Building Plans Completed Index.

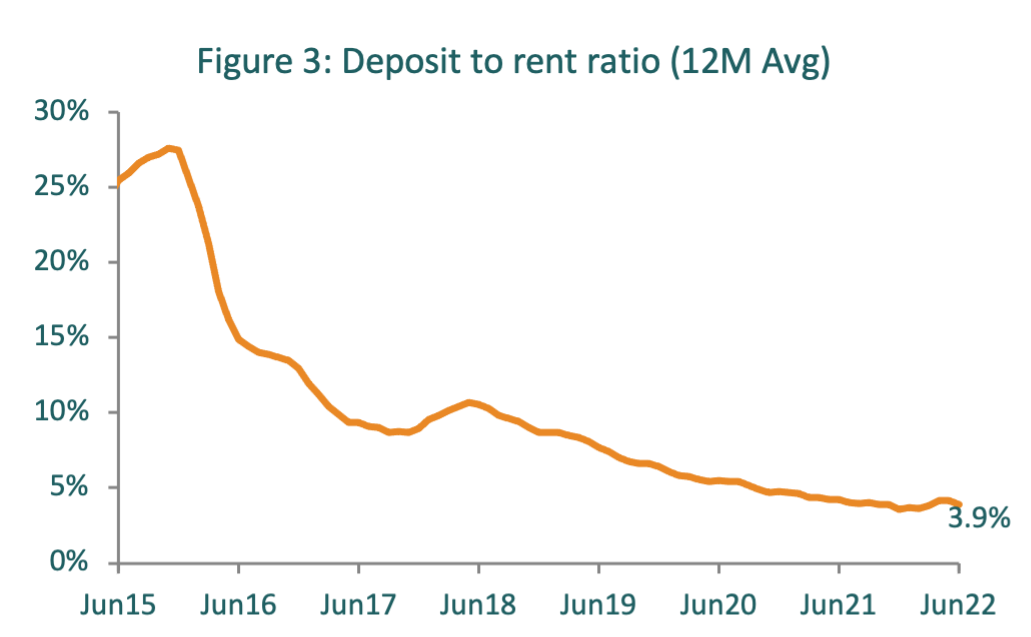

Rental yields

The gross rental return on a residential property was estimated at 6.7% on an annual basis. This reflects 0.1 and 0.2 percentage points below the levels seen at the end of the prior quarter and corresponding period of 2021, respectively. Whilst rental yields remain competitive by regional comparison, the cost of amenities and inflation in general appears to be accelerating at a much higher pace than the growth in rental yields – a common phenomenon witnessed across the world. This has a negative impact on the profitability of real estate business particularly in an environment where the cost of capital is also increasing. In effect, inflation in Namibia averaged 4.7% in the 12 months to June 2022, while the repo rate cumulatively increased in the last 12 months by 225 basis points to 5.50% .

Conclusion

It is increasingly becoming more expensive to maintain a home compared to a year ago due to higher cost of building materials such as steel and other essential household amenities. Rising interest rates are also lifting bond instalments, yet it is difficult for landlords to pass on sharp cost increases to tenants in the current strained economic environment. Looking ahead, we expect nominal rentals to continue to rise slowly in the next year or so but at a rate lower than the consumer inflation rate.

Frans Uusiku

Marketing Research Manager

For more information, please call: 061 – 299 2222 or visit www.fnbnambia.com.na

To make sure we reach targeted readers audience, selective distribution is done throughout the month on a weekly basis. This ensures the availability of the magazine in strategic locations for readers to pick up for free and read.