Market Review - June/July 2022

Residential property market stabilising after pandemic

Residential property market stabilising after pandemic

The FNB residential property price index posted a 12-month average growth of 7.1% at the end of 2021. The volume index growth ebbed to 6.6% from 21.7% a year ago. The national weighted average house price ended the year at N$1 181 225, down from N$1 240 943 in 2020. While the price index growth remains relatively robust by annual comparison, shrinking transactional volumes are causing the average house prices to dip. Sales of residential plots contracted by an average of 16.2% at the end of 2021, up from -45.2% at the end of September 2021, but lower than the growth of 18.0% recorded in 2020. Given the tight fiscal state of government and the sales of land being regarded as one of the critical sources of revenue for local authorities, optimal delivery of residential land is likely to prove challenging in the short-to-medium term.

The recent strength in the housing index growth, which was short-lived, is associated with the aggressive interest rate cuts that started in early 2020 at the start of the Covid-19 crisis. The cumulative reduction in interest rates had stimulated a strong surge in home buying. The negative economic impact of the Covid-19 pandemic had led to forced property sales. However, the real estate market is reshaping, along with the reopening of the economy and resumption of a tight monetary policy cycle. The rental market continues to pick up steam.

The FNB residential rental index for the fourth quarter of 2021 posted a smaller contraction of 0.7% - significantly better than the 2.1% recorded a year earlier. In view of Angola being an important fraction of Namibia’s property market development, increased global oil prices are likely to improve economic prospects there, resulting in a probable return of Angolans’ leisure and educational travels to Namibia. This, coupled with the expected rebound in domestic economic activity, could be a welcome tailwind for the Namibia property market in the short-to-medium term.

However, the residential property market is highly sensitive to interest rate adjustments. This highlights households’ debt to disposable income estimated around 89%. The ultra-low-income market struggles to find affordable housing yet this market accounts for 70% of the total addressable market and the need is for affordable housing below N$500 000.

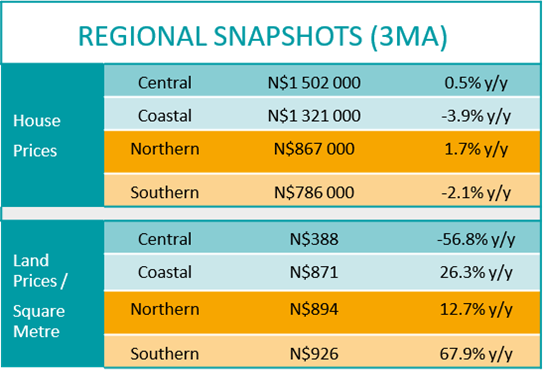

In the central region, volumes moderated downwards to 18.3% at the end of 2021 from 34.8% recorded in 2020. Meanwhile, the central house price index 12-month growth hovered at 8.7%. Whilst housing demand continues to surge, affordability remains constrained by elevated costs of building materials and land. The low-income housing market is in dire need, given the proliferation of the informal sector.

The coastal region was the strongest performer with the 12-month average price index growth recorded at 15.9% at the end of 2021 (10.2% in 2020). However, the volume index was only 7.7% over 12 months. This market has been buoyed by younger buyers with their different residential needs, smaller family sizes and therefore greater disposal income, side hustles, and access to financing.

The northern house price index posted a 12-month average growth of 3.9% at the end of 2021. This is the deepest contraction recorded since April 2014 due to fewer housing developments.

The northern volume index also had a 12-month average contraction of 1.9% over the same period. The scarcity of serviced land and expensive building materials are some of the challenges being cited by property developers. The 3-month average land price was calculated at N$894/m² at the end of 2021, way above the long-term N$447/m². This could be due to recurring resales of residential plots by real estate investors at exorbitant prices. Recently the Ministry of Urban and Rural Development announced the unveiling of Extension 24 in Ondangwa, with 321 residential erven earmarked for the low-and middle-income class. This is expected to reignite trading activity in the near term.

The southern house price index recorded a 12-month average contraction of 3.0% at the end of 2021. This is the first contraction recorded since October 2020 and highlights the return to the pre-Covid-19 state, characterized by fewer transactions. The volume index had the 12-month average growth settling at 17.8% from the peak of 28.1% recorded a year ago. Only about 72 houses were handed over to their beneficiaries towards the end of 2021 by the National Housing Enterprise. In the interim, local authorities including Keetmanshoop are urged to familiarize themselves with the Informal Settlement Upgrading Project model being implemented in Windhoek for future roll-out in their respective towns. This is expected to create greater housing relief, especially within the ultra-ultra-low-income segment.

Frans Uusiku

Marketing Research Manager

For more information, please call: 061 – 299 2222 or visit www.fnbnambia.com.na